Why Get Title Insurance?

Title insurance protects you from any losses that happen after a real estate purchase. Title companies work to find and correct any issues in the title of the property before the property is sold.

How We Make Your Largest Transactions a Breeze

We make your largest commercial real estate transactions simple and quick while still providing you with the one-on-one service that you need.

Prosperus: Your Best Friend for Real Estate Transactions

We provide personalized, one-on-one service that makes closing on your client’s real estate transaction quick and easy.

Feel Confident with Every Closing

We have the attention to detail that you need for all of your mortgage and home equity originations to make sure that all of your mortgage loans are accurate.

Keeping Transactions Moving

We work diligently to keep all of the parties involved on track so that we can get your transaction closed quickly and clear up any title issues early. We check if any precontract information is needed to get the property under contract and research the property for restrictions, easements, mineral rights and other items.

The Experience You Need

With more than 100 years of combined industry experience, we know how to make transactions as seamless as possible by answering your objection letters and providing quick responses from our underwriters.

FAQ: Homebuyers & Sellers

Title insurance protects people from losses that may happen after they buy real estate. Losses can happen due to unknown liens, defects, or encumbrances on the property that existed before the purchase. Most lenders will require you to buy a policy to protect their interest.

Title insurance agents try to find defects in the title that need to be corrected before the owner of the land sells it. They look at public records, including deeds, mortgages, wills, divorce decrees, court judgements, tax records, liens and maps.

You would need to purchase an owner’s policy. It protects you from the covered risks listed in the policy. The cost is included in your closing costs. The policy covers up to the value of the property at the time that the policy is purchased.

You can use any title agent. Your real estate agent or lender may recommend one to you but the choice is yours if you are simultaneously purchasing a loan policy for your lender. If not, this detail can be negotiated between the parties. If you are going to look for one, ensure that the agent is licensed in Texas. You can verify by calling the Texas Department of Insurance (TDI) Title Agent Licensing Office at 512.676.6475 or by emailing TDI-TitleLicensing@tdi.texas.gov.

The cost for the title insurance is based on the property’s sale value. The rate paid is determined by the Texas Department of Insurance. View the rates by clicking here.

Check the Closing Process infographic by clicking here.

Keys are delivered shortly after the transaction is fully closed. The seller will typically authorize release of the keys by their agent or the title agent when the sales proceeds are funded. It can take up to two days if any of the parties are located out of town.

It is not common in our region for the seller to attend the closing with the buyer.

Net Sheet Calculator

Save, send and edit different transactions — everything you need in one calculator.

Our Secure System

We can provide you with the documents that you need — quickly and securely!

The Prosperus Web App

You’re busy. We get that! Get the Prosperus web app and take some of our services with you everywhere you go.

- Create your own account

- Save net sheets and send them directly to your sellers or buyers

- Keep everything in the palm of your hand

Premium Rate Calculator

Calculate the cost of your policy by typing in the policy amount — it’s that easy! Our premium rate calculator does the work for you.

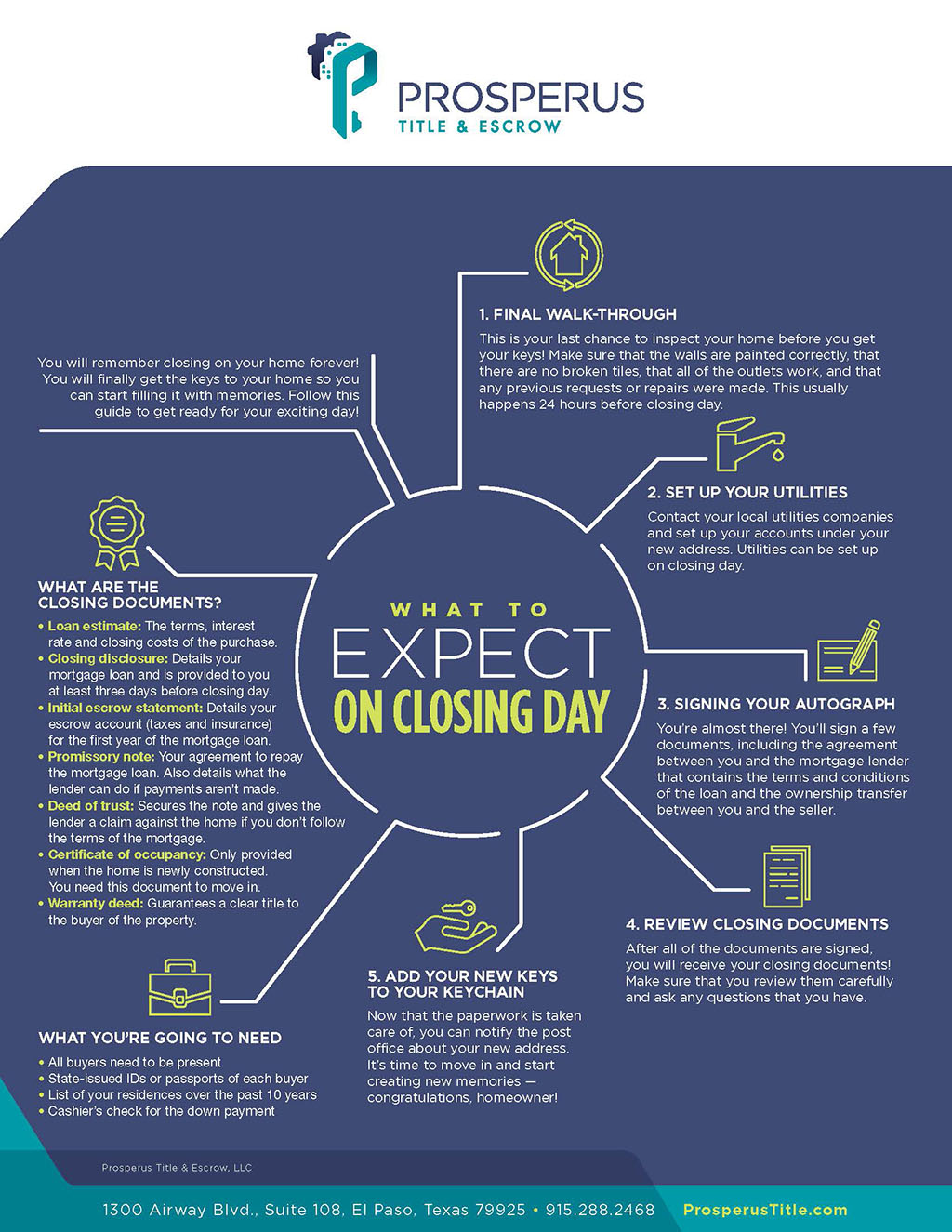

GET STARTEDWhat to Expect on Closing Day

We want you to have the best experience while you’re closing on an exciting new chapter of life! Here’s what you need to know so you’re prepared.

DOWNLOAD